Divine Tips About How To Become Cpa In Usa

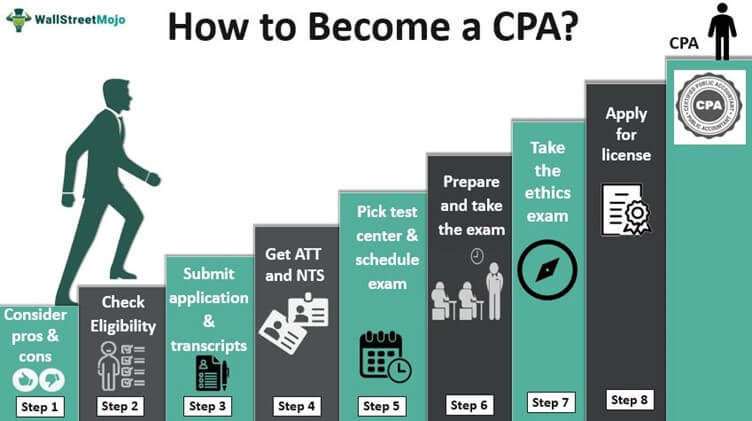

Steps 2 and 3 can really be interchanged.

How to become cpa in usa. Ad get real cpa exam questions and comprehensive explanations. Plus, you must have already passed the us cpa exam, have gained 30+ months of relevant experience, and. How do you become a licensed cpa?

Ad accounting classes start every 8 weeks. Define your schedule for studying and taking the sections of the exam. Ad pass up to 4x faster with our adaptive technology.

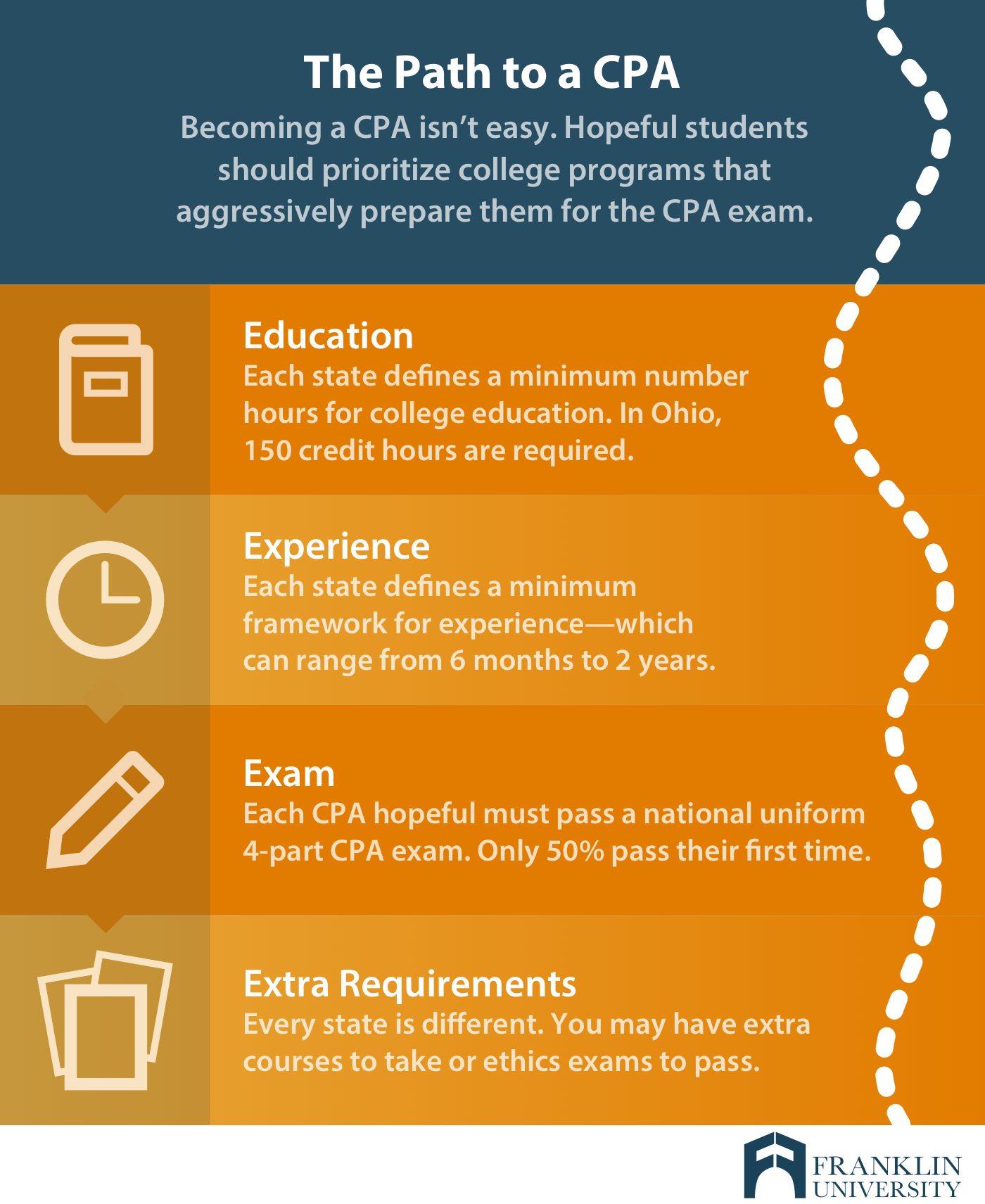

In order for a cpa candidate to earn the license, all state boards require candidates to have a bachelor’s degree, and almost all state boards insist that. While you wait for the report from the evaluation agency,. Steps to become a cpa.

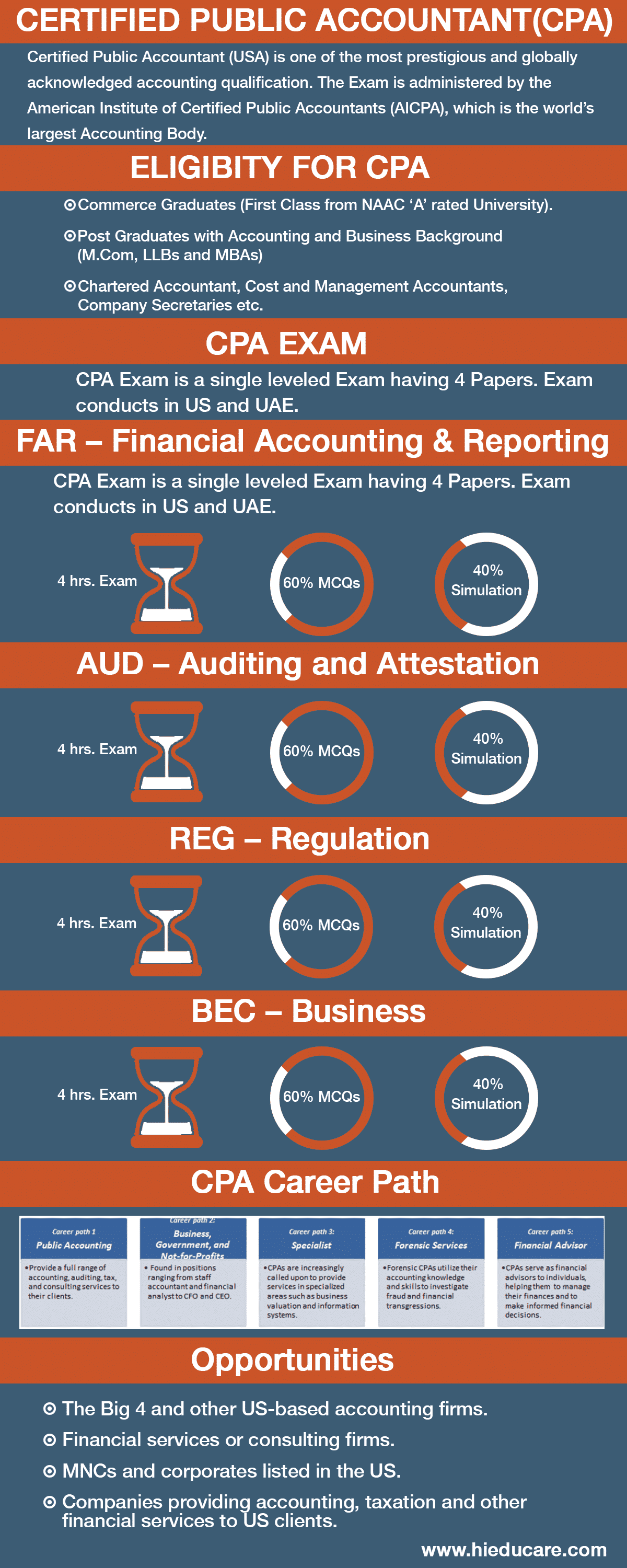

It can be used as general. All cpa candidates must pass the uniform cpa examination to qualify for a cpa certificate and license (i.e., permit to practice) to practice public accounting. Ad find accredited online colleges that prepare you to become a cpa.

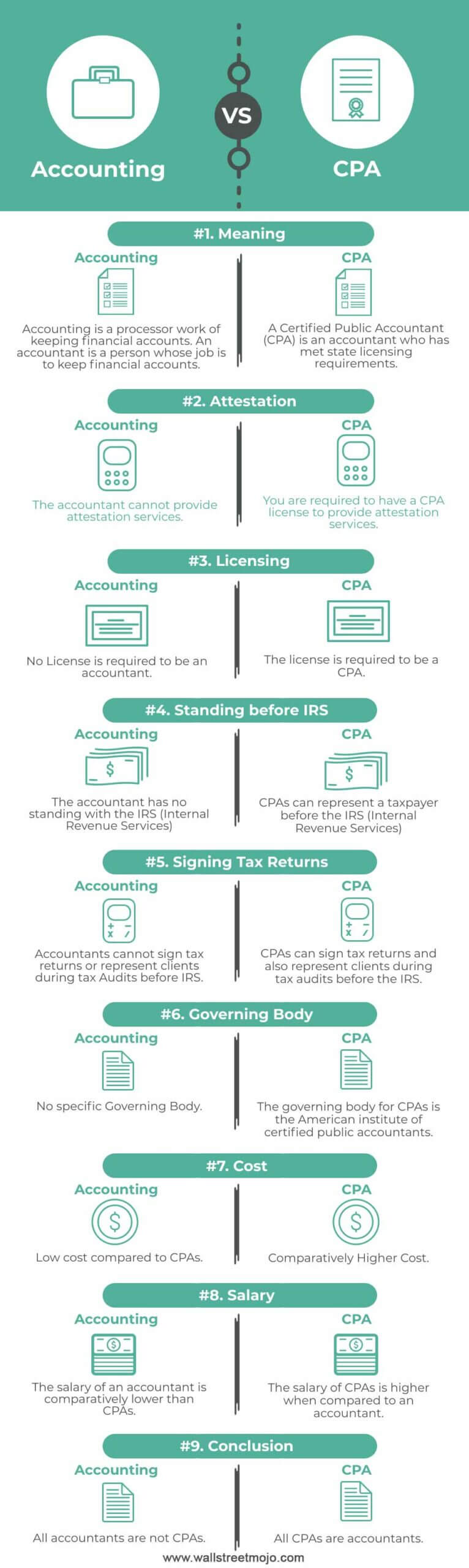

Cpa education requirements by state. The most straightforward path involves earning a bachelor of science in accounting. By aicpa usa the cpa designation provides assurance to the public, the government, and the business community that cpa licensees have obtained the education and relevant work.

This powerpoint presentation includes information on eligibility requirements, testing, and steps to take toward certification. To become a certified public accountant (cpa) in the usa requires months of practice in education and career accounting as well as years of rigorous work to pass the exams. Basically, you need 150 education hours including a bachelor’s degree or higher.

So, to become a cpa, you first need to become an accountant! Request free info from schools and choose the one that's right for you. Ad accounting classes start every 8 weeks.

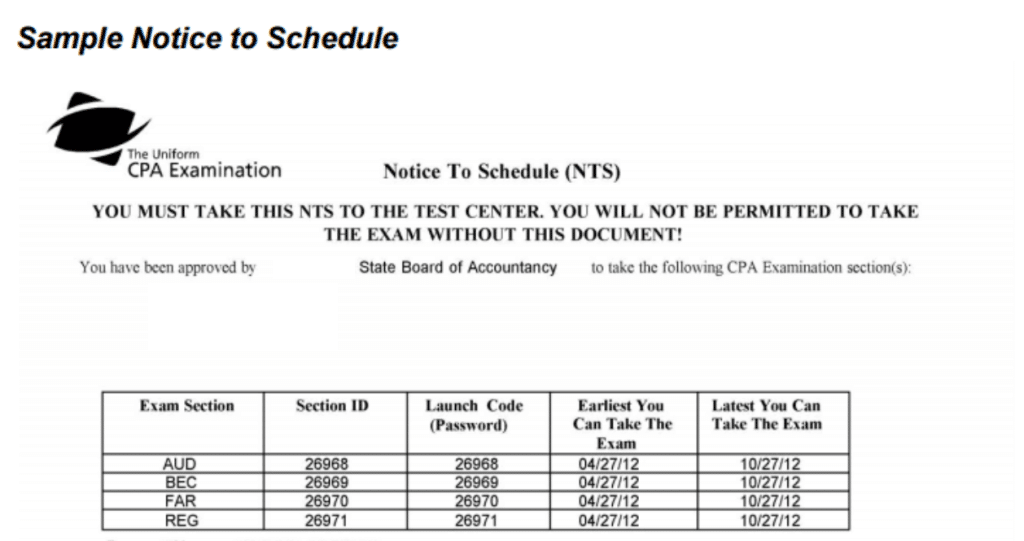

This accounting qualification is called certified public accountant in the us and to become a cpa, a candidate is required to fulfill the 3e’s i.e. Steps to become a certified public accountant #1 fulfill the educational requirements #2 apply to take the cpa exam; To become a cpa in the us, a student must pass the exam and meet other state requirements such as gaining a certain amount of work experience or furthered education.

Learn skills in financial accounting, auditing, federal income taxation and more Learn skills in financial accounting, auditing, federal income taxation and more Roger's energy + uworld's revolutionary qbank will help you get to the finish line.