Inspirating Tips About How To Buy Municipal Bond Funds

The potential to earn passive income with real estate, without buying an entire building.

How to buy municipal bond funds. The 2022 best mutual funds logo and accolades are available for licensing through investor's business. An investor can buy and sell bonds directly through an online brokerage account. How to research and buy bonds;

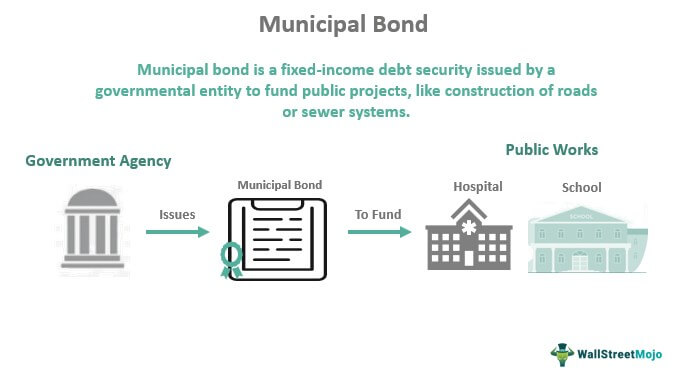

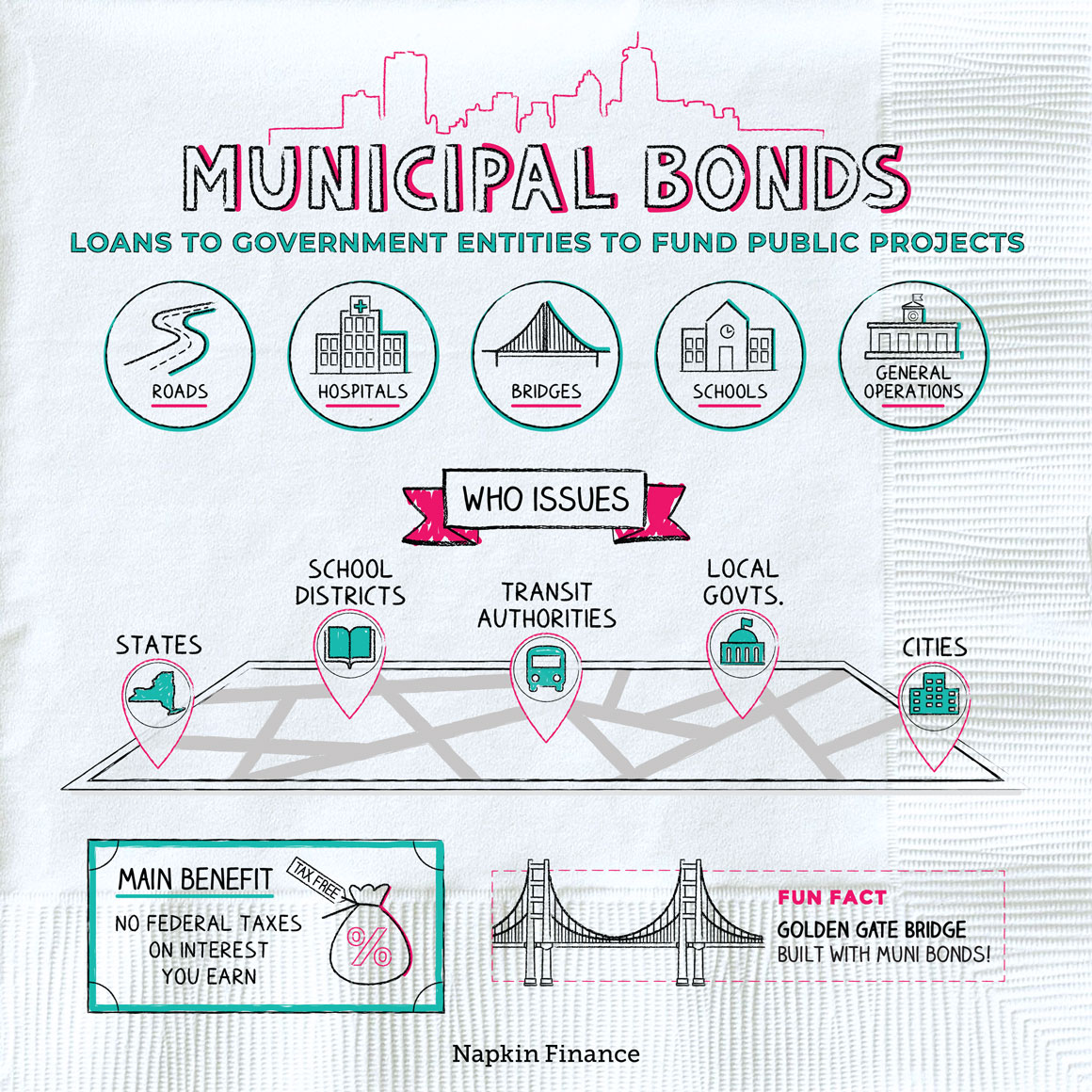

Ad real estate investment opportunities that give you the potential to earn passive income. Like other bonds, investors lend money to the issuer for a. How to buy municipal bonds.

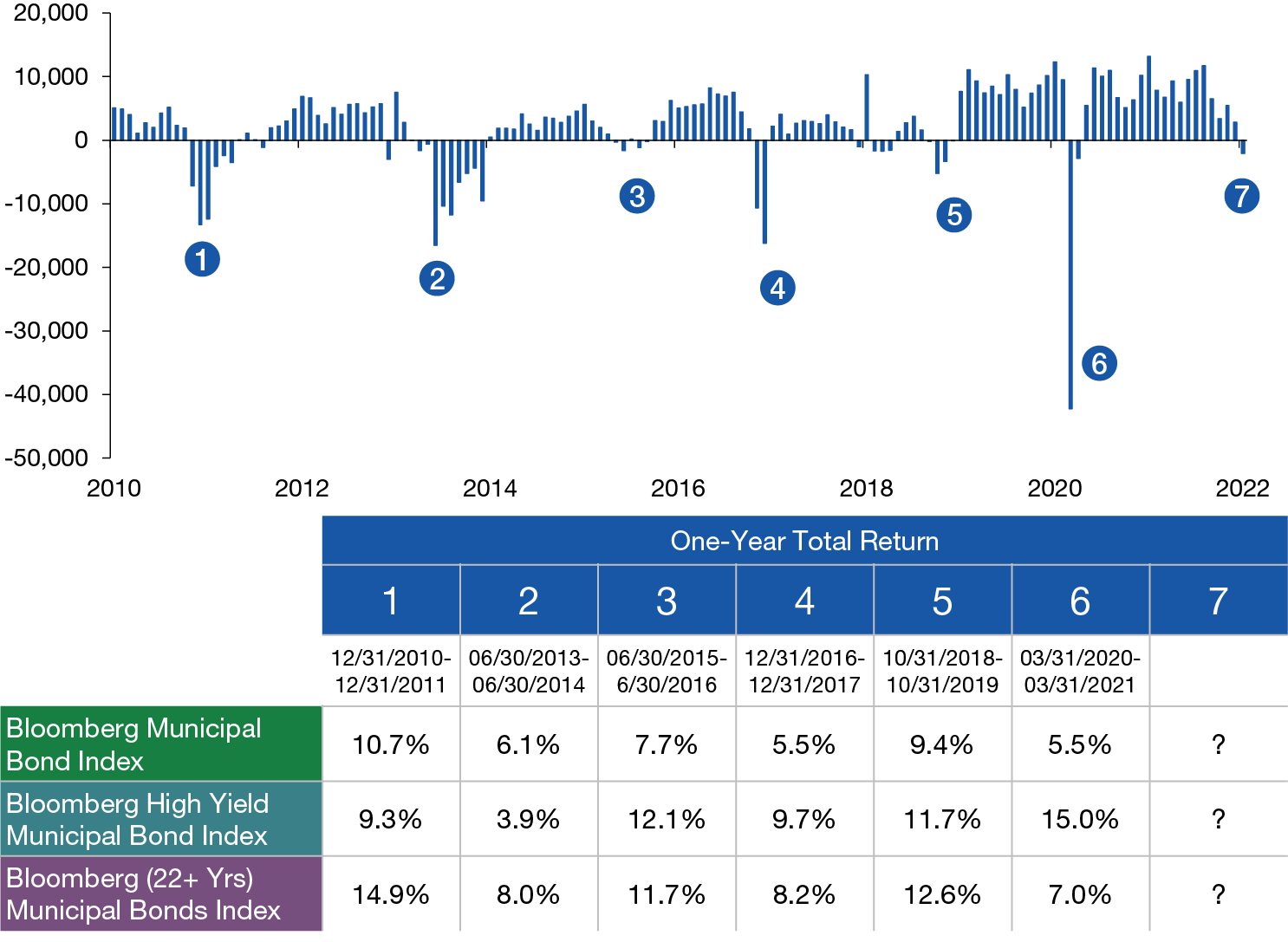

You can do so through either a traditional or online brokerage firm or directly from a mutual fund company. Investors rely on bonds for. Buying shares in a mutual fund that invests in muni bonds is yet another way to participate in the municipal bond market.

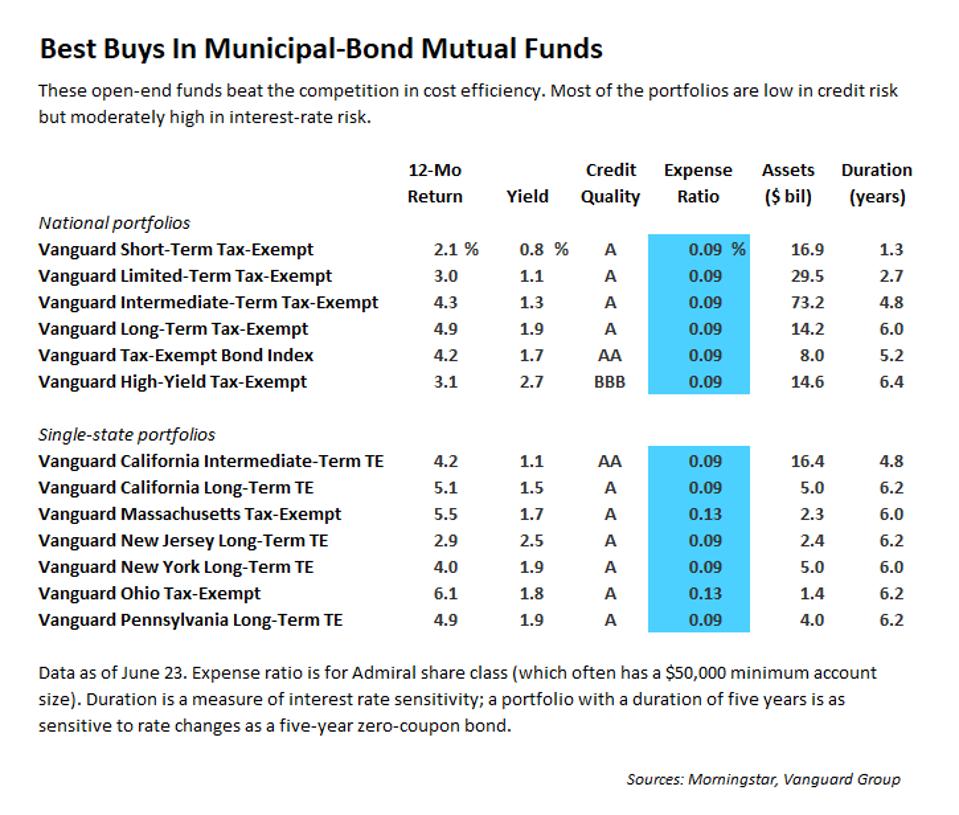

For a particular class of investors, one with a sizable tax. You would simply buy shares in the municipal bond mutual fund. Of 454 municipal bond funds at least 10 years old, 31 of them, or 7%, won awards.

They tend to pursue a set maturity strategy,. Mutual funds that fully or partially invest in municipal bonds can be an. You can easily invest in a municipal bond mutual fund directly by opening an account with a fund company that sells municipal bonds funds, or through online means via a.

Bond mutual funds may be actively or passively managed, funds typically follow a particular type of bond—corporate or municipal. Ad aim to maximize income potential with municipal bonds and pimco strategies. You can purchase muni bond funds just as you would other investments, either via your broker or a bank.

How to buy municipal bond funds. They also can be purchased through a full. Ad seek more from municipal bond funds.

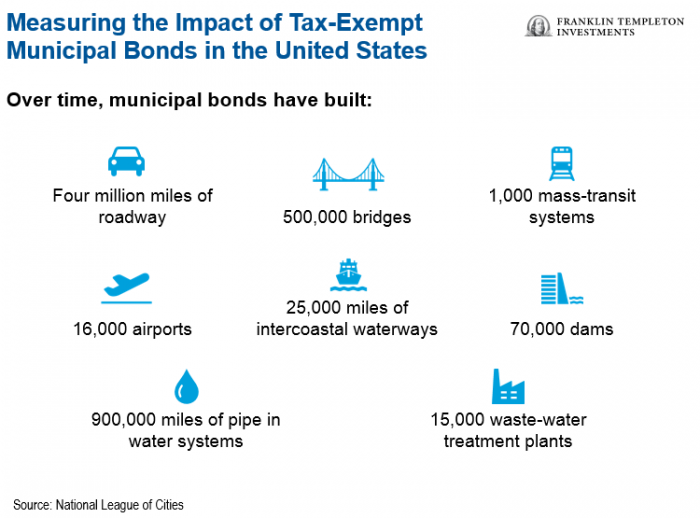

For those with a more national focus,. Bond etfs vs bond funds; A municipal bond is a debt issued by a state or municipality to fund public works.