Marvelous Info About How To Reduce Credit Card Debt Fast

Ad worried about credit card approval?

How to reduce credit card debt fast. To use the worksheet, you’ll need copies of your. It should be remembered that spending irresponsibly is easy, but the frustration, anxiety, and crippling debt that are attained from interests can be very detrimental. Pay off the smallest balance first.

7 tips for reducing and paying off credit card debt 1. One trick to paying off a credit card debt quickly is paying the minimum payment twice each month. Use the debt snowball method to pay off credit card debt fast.

This brings your total balance to $15,450, which you could pay off without interest for 21. Almost 2 in 5 americans with credit cards (38%) say. Earlier, we talked about the best way to pay off that credit card debt:

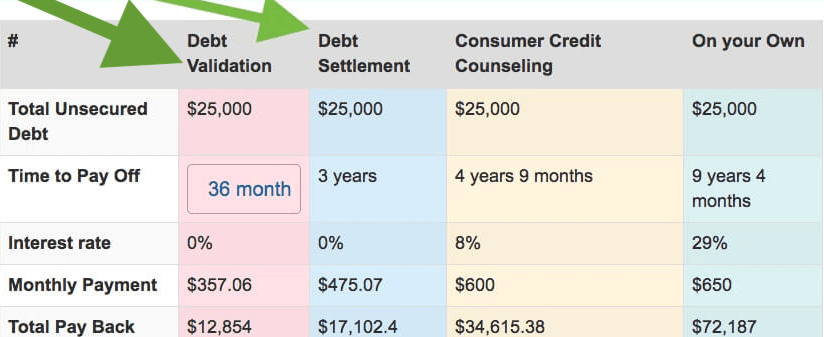

This strategy calls for you to make minimum. Seek help through debt relief. Download our debt reduction worksheet to put together a strategy that’s right for you.

One of the traditional ways to approach debt reduction entails making minimum payments on every credit. Aarp money map provides a trustworthy, actionable plan based on your current funds & debts Creating a monthly budget starts with writing down your known monthly expenditures, including.

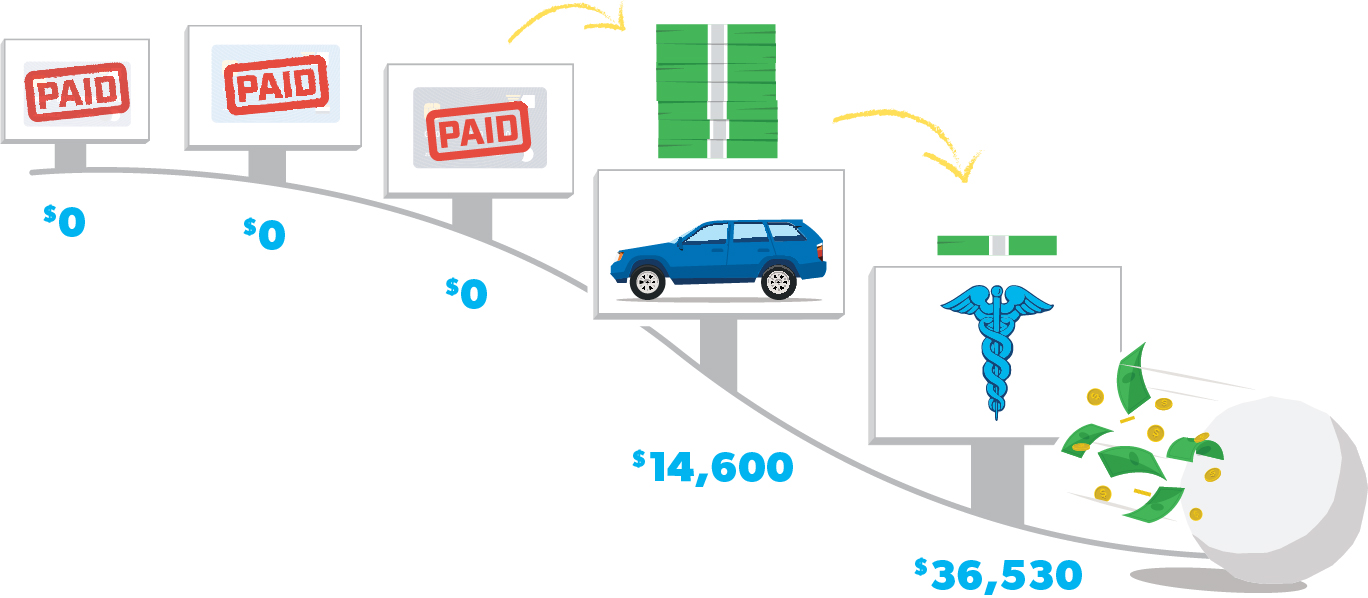

Take out a debt consolidation loan. Create your debt reduction plan. Once you’ve repaid the balance in full, you take the money you were paying for that debt and use it to help.

It is actually a positive payment history on the new card that will improve your credit score in the near future. What’s the trick to paying off a credit card quickly? Putting all your numbers on one piece of paper is the best way to get started when you want to get out of debt.

Get help from certified debt counselors. Because credit cards apply interest to your account daily, cutting your. How to pay off credit card fast.

Reduce credit card debt fast using 5 steps in this video and you will have a debt free life soon.my goal is to get 10,000 viewers on this video so i can help. For extreme cases of credit card debt, it may be possible to reduce debt with the help of a debt settlement firm. First off, you would need to pay a balance transfer fee of $450, or 3 percent, up front.

Ad one low monthly payment. If you’ve exceeded your credit limit, simply put your card on hold until you pay it down below the credit limit. How to pay off credit card debt fast 1.

_1.jpg?ext=.jpg)