Formidable Tips About How To Reduce Your Income Tax

This will give you a higher tax.

How to reduce your income tax. The other way to reduce your taxable income is by spreading your income. Expenses for medical and dental expenses that exceed 7.5% of your agi 5. If you are an employee.

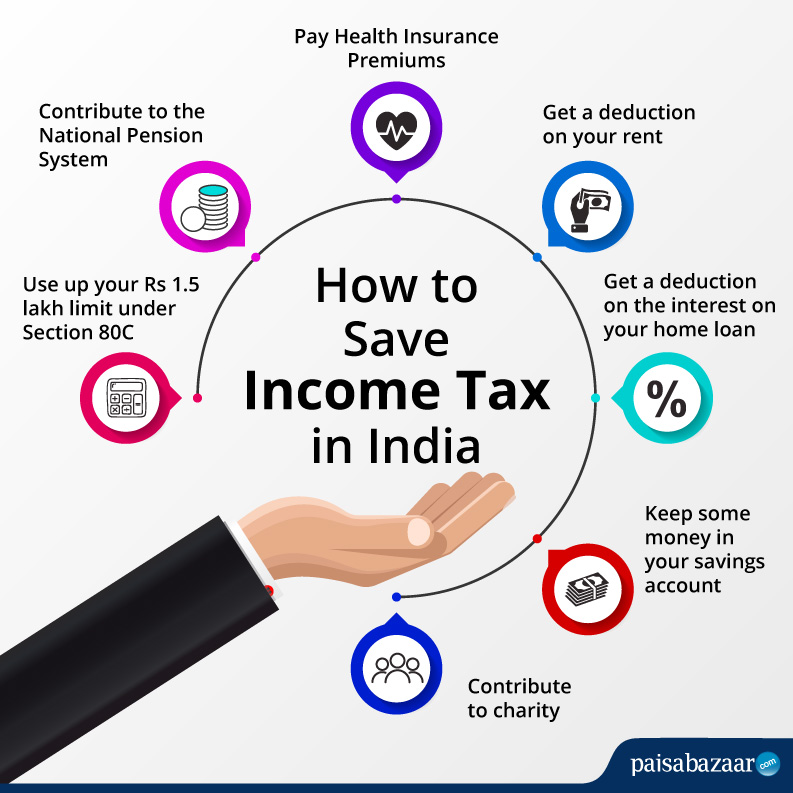

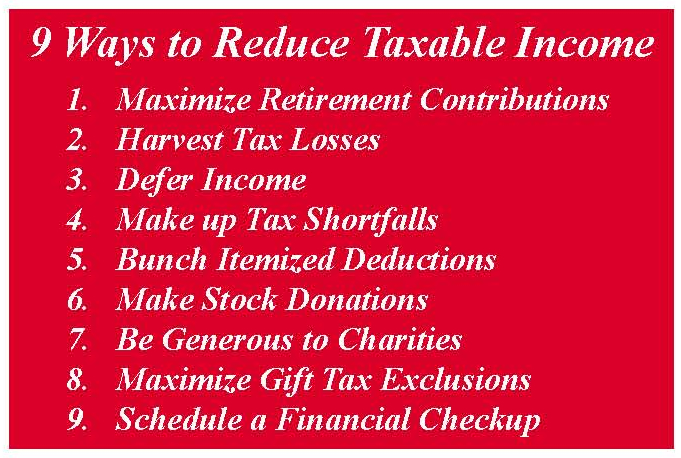

Take advantage of these strategies to save on your income taxes. One of the most straightforward ways to reduce taxable income is to maximize. You’ll need to keep good records, eg receipts and log.

8 tips to reduce your tax bill for the next tax season. The retirement savings contributions credit, or saver’s credit, offers taxpayers a credit of 10%, 20% or 50% of contributions to retirement savings accounts such as a 401k or an. You can reduce your tax bill by claiming as many valid business expenses as you can.

50 best ways to reduce taxes for high income earners. Your first step should be to make sure enough money is being withheld from your. The good news is that with a combination of tax deductions, tax credits, and contribution strategies, you can reduce your tax bill by reducing your taxable income.

The irs doesn’t tax what you divert directly from your paycheck into a 401 (k). Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills. After you make the decision to become financially independent i think it is very important to learn the basics of the tax system, learn how taxes are calcula.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. A retirement plan is one of the few relatively painless and authorized ways to reduce your taxable employment income. An individual with a taxable income of $60,000 will save about $1,070 in his income tax when he contributes $15,300.

Reduce your state tax bill by using municipal bonds instead of corporate bonds or bank cds like treasuries, municipal bonds are often exempt from state and local taxes (and also federal. Your tax bill is calculated on your net profit. The common theme here for reducing your taxable income is to invest your money.

Up to 25% cash back step 4: What are tax reliefs (& how do they reduce income tax)? There are a number of ways that you can legally reduce your income.

The more deductions you have, the. The total sum of state and local income taxes, real. Tax reliefs are deductions made by iras on your total payable income tax.

Investing can significantly defer and even reduce your tax liability in some cases. This savings in tax is immediate. Besides reducing your taxes, retirement plans help.

/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)