Breathtaking Info About How To Repair Credit After Bankruptcy

You should monitor your credit for a number of reasons, but especially if you recently filed for bankruptcy.

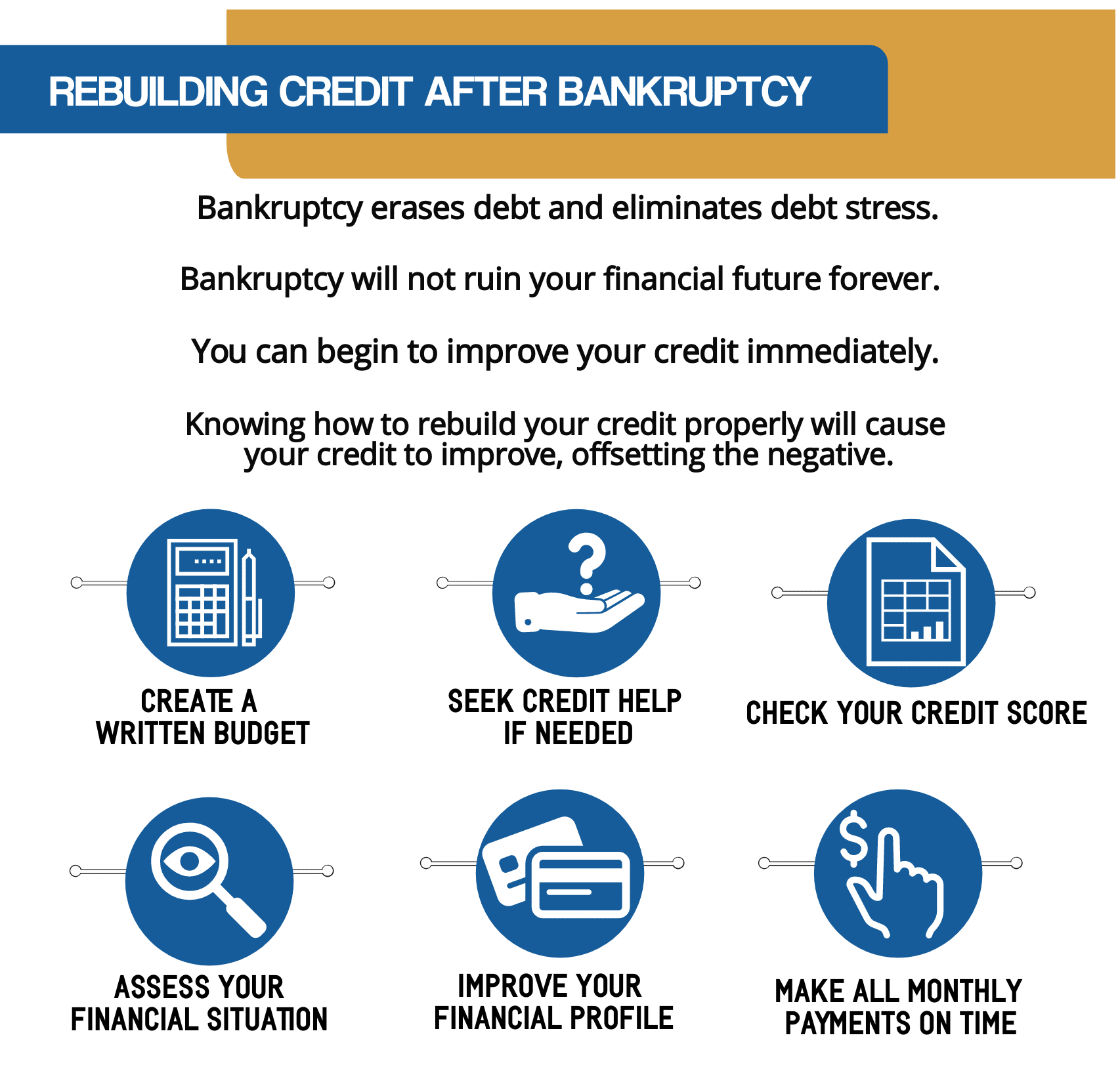

How to repair credit after bankruptcy. Here are five things you need to know about getting your credit repaired once your debts have been discharged. Open two secured cards as. The first step in repairing your credit is knowing what goes into your credit score:

Ad learn 7 actionable tips to help rebuild your credit and improve your score. Keep an eye on your credit so you can determine where to focus. Credit repair is the first step in that process.

Learn more about ways to help you rebuild your credit score. Monitoring your credit following the bankruptcy process is critical. Ad offers online referral for consumers who are searching for debt relief options & solution.

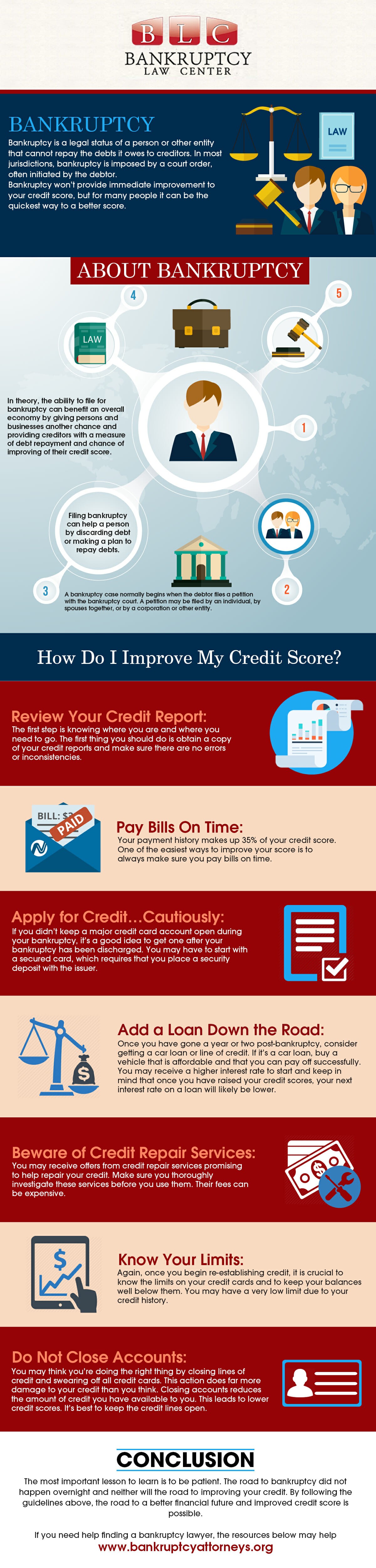

You get these three reports under federal law. After bankruptcy credit repair, how long after bankruptcy does credit improve, building credit after bankruptcy, getting credit after bankruptcy, after bankruptcy credit card, best credit card. It varies from company to company, but many credit repair outfits also offer credit counseling services.

Apply for a new line of credit. Rebuilding credit after chapter 7, credit repair after. In the meantime, you can start improving your credit right away by.

Reducing your dependence on credit cards can be an important step toward rebuilding credit after bankruptcy. However, the strategic use of secured credit cards can also. Here are some other ways to help your credit scores that don't involve.

Bankruptcy stays on your credit report for seven or 10 years, but its impact lessens as time passes. Request three free credit reports and check that the balance is zero. Given the recent bankruptcy you will not be able to qualify for regular credit cards, but secured cards will be just as effective in helping your score scores recover.

Worried about your credit score following a bankruptcy? Ad 2021's top 5 credit repair companies. How to build credit after bankruptcy.

While many consumers, after filing bankruptcy, avoid new credit at all costs due to the fear of repeating past mistakes, it’s crucial to your credit restoration success that you begin. Our las vegas bankruptcy lawyers explain the process for building back your credit score. This goes beyond your credit report and looks.

You can repair your credit after bankruptcy by applying for a new line of credit and demonstrating that you can make payments on time, every time. The most important step in rebuilding your credit is to pay your existing debt obligations on time and in full every month.